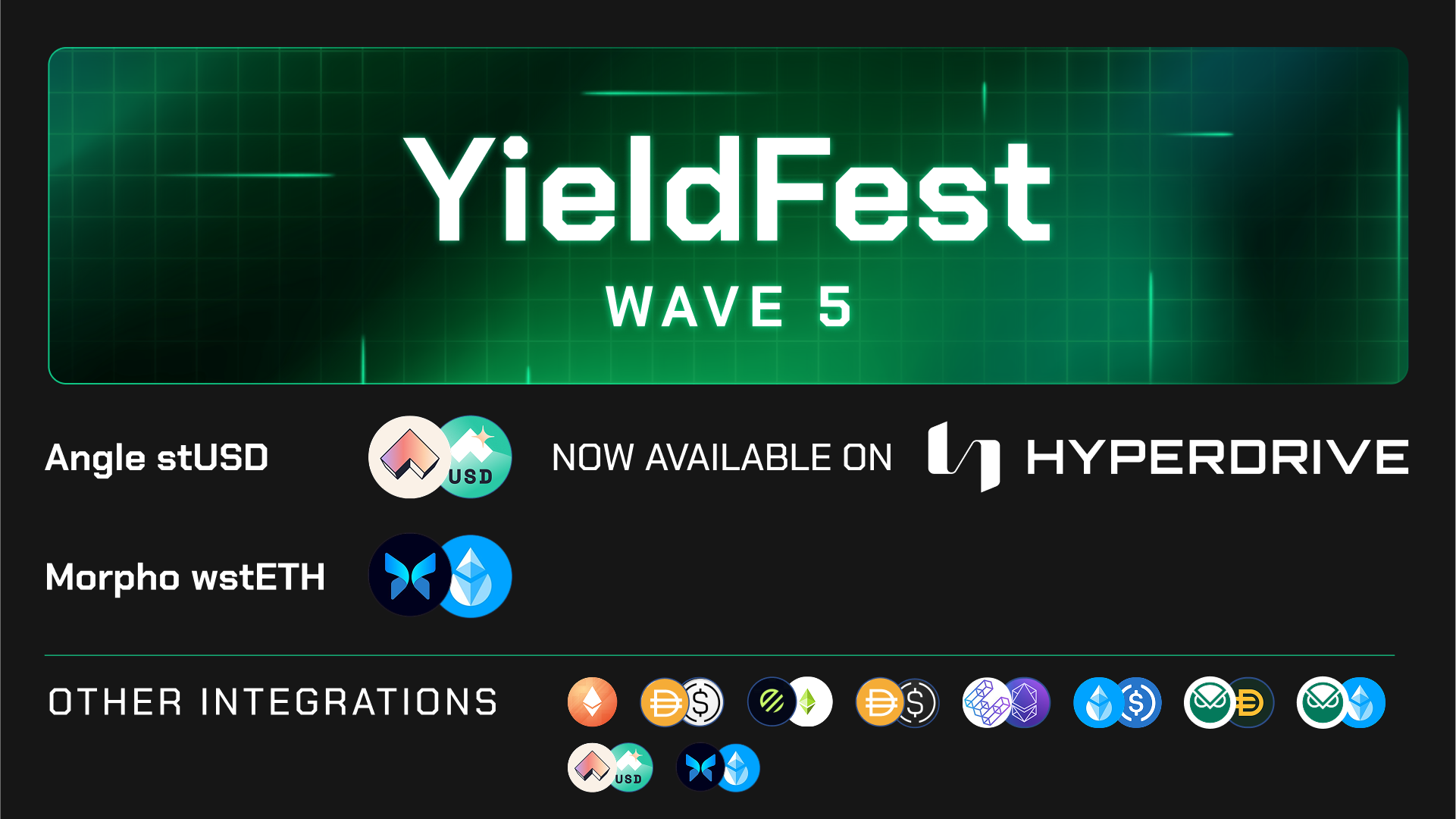

Wave 5: Angle’s stUSD and Morpho's wstETH/USDA Are New Yield Sources on Hyperdrive

We’re proud to share that Angle’s stUSD and Morpho’s wstETH/USDA are now available as yield sources on the Hyperdrive Protocol.

We’re rolling into the fifth week of YieldFest with more exciting integrations to announce. Today, we’re proud to share that Angle’s stUSD and Morpho’s wstETH/USDA are now available as yield sources on the Hyperdrive Protocol (developed by DELV and this instance operated and managed by the Element DAO).

"These new additions can empower users to tap into a wider range of yield opportunities and provide more options for strategies such as yield looping," said Charles St. Louis, CEO of DELV. “Integrating stUSD and wstETH on Hyperdrive is another important step in advancing the DeFi space and growing the ecosystem.”

What is stUSD?

stUSD is a yield-bearing stablecoin developed by the Angle Protocol, and it’s designed with the goal of maintaining a 1:1 parity with the U.S. dollar. It’s collateral-backed, meaning that it is minted by users who deposit supported assets, and it can be used to earn yield passively, to provide liquidity, or to engage in lending, borrowing, and trading.

“For us, DeFi will thrive when we collectively keep pushing new primitives one after another to rebuild a holistic permissionless financial ecosystem,” said Pablo Veyrat, co-founder of the Angle Protocol. “Hyperdrive is now at the forefront with its fixed rate offerings. We’re glad and excited to pioneer with the stUSD market on this new case with them.”

Integrating stUSD adds more depth potential to Hyperdrive’s liquidity pools, providing access to new yield earning opportunities.

How to get started with stUSD on a Hyperdrive pool

If you’re a liquidity provider, using stUSD is simple. Here’s what you can do:

- Acquire stUSD by depositing USD stablecoins into the Angle Protocol savings product, or acquire stUSD directly through 1inch, ParaSwap, Uniswap, Matcha, CoW Swap, or other AMMs.

- Access the Hyperdrive app.

- Deposit your stUSD by navigating to the LP tab.

- Earn yields through Hyperdrive's optimized liquidity pools.

And if you’re a trader, here’s how it works:

- Acquire stUSD by deposting USD stablecoins into the Angle Protocol savings product, or acquire stUSD directly through 1inch, ParaSwap, Uniswap, Matcha, CoW Swap, or other AMMs.

- Access the Hyperdrive app.

- Deposit stUSD on Hyperdrive.

- Open a long position at a fixed rate or a short position at a variable rate.

What is wstETH/USDA?

wstETH is a wrapped version of stETH (staked Ether) that’s compatible with the ERC-20 standard, and is designed to maintain a fixed balance. Instead of the balance increasing over time (like stETH), the value of wstETH may increase relative to ETH if staking rewards accrue.

In this integration with Hyperdrive, wstETH will function as collateral for the Morpho market, and users will supply that market using USDA. Morpho is a trustless and efficient lending primitive that allows users to pursue their strategies to generate returns for staked assets and find opportunities for liquidity providers.

USDA is a decentralized stablecoin that’s pegged to the U.S. dollar. It’s designed to maintain a stable value and is widely used for trading, lending, borrowing, and yield generation.

How to Get Started with wstETH/USDA on a Hyperdrive pool

wstETH will serve as the collateral for the Morpho market and the Hyperdrive Protocol supplies USDA to that market. That means you only need USDA to participate.

If you want to provide liquidity, here’s how it works:

- Acquire USDA by supplying a supported asset as collateral, or purchase it directly through an exchange like Uniswap.

- Access the Hyperdrive app.

- Deposit USDA on Hyperdrive by navigating to the LP tab.

- Earn yield with USDA staked on Hyperdrive. You’ll gain returns from staking and trading fees.

And if you’re a trader, here’s what you can do:

- Acquire USDA by supplying a supported asset as collateral, or purchase it directly through an exchange like Uniswap.

- Access the Hyperdrive app.

- Deposit USDA on Hyperdrive.

- Open a long position at a fixed rate or a short position at a variable rate.

There are many more weeks of YieldFest left to go, and we’ll have more exciting announcements about new yield sources soon, so be sure to stay tuned.

Missed our earlier posts? Check out Part 1, Part 2, Part 3, and Part 4 to learn about our other YieldFest integrations. Plus, take a look at our YieldFest kickoff announcement for additional details (including our role as a non-exclusive service provider to the Element DAO).

Join the Party:

Note: This blog post is general in nature and for informational purposes only. It is not legal, tax, investment, financial or other advice, nor is it a comprehensive or complete statement of the matters discussed. It is not a recommendation of an investment strategy and should not be used as the basis of any investment decision.

All transactions and investments involve risk, and past performance does not guarantee future results. Certain complex strategies carry additional risk and are not appropriate for all users. As with any DeFi or crypto position, you may incur losses. You alone are responsible for evaluating the benefits and risks associated with any decision to use Hyperdrive and the risks or concerns with any underlying yield source.

Hyperdrive is not currently available in certain jurisdictions, such as the USA and the UK.